Professional valuation

Professional valuation

Those involved in buying, selling or financing a company or company activities, must firstly ask themselves what the added value is and not what the cost is. For a combination of people and resources, the future is the determining factor in establishing the current value. And not the past! After all, value and cost price can differ substantially!

The cost price of a Rembrandt painting, for example, is not proportionate to the price most people are willing to pay. Why do people pay such a high amount? Because they expect, in one way or another, to enjoy (the even higher proceeds of) such a painting in the future. They attach value to this expectation for which they are willing to pay a certain price. Expectations of some people will run higher that those of others and so different people will value the painting differently. Read: pay a different price.

Valuation

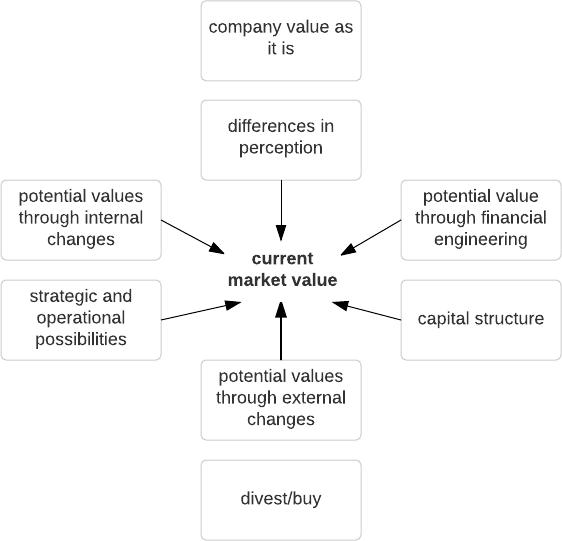

Value – the basis by which to calculate a price – is a subjective concept. What applies to paintings also applies to companies or business activities. Different parties therefore come to different values. To determine a reliable price means mapping the various criteria that determine the price. Value Creation has developed its own method for this.